info@comptools.com

| Comp Tools Software, Inc. |

|

info@comptools.com |

|

Tutorial

A 55-year-old worker has been seriously injured in a fall.

He is currently receiving total disability at a rate of $600.00 per week.

It is expected that he will reach MMI in 12 months. He has collected benefits for 4 years.

At that time it is

unclear whether he will be able to return to work at a permanent

light duty position which pays less and entitles him to $400.00 per week

or be disabled for the rest of his life. In this jurisdiction he is

entitled to 512 weeks of wage loss benefits if he has a work capacity.

If he has no work capacity he is entitled to lifetime benefits and a cost of

living adjustment. Medical benefits are not closed out in a settlement.

The claimant attorney estimates that there is a 40% chance that he will

be entitled to lifetime benefits. This example will be evaluated from

the claimant attorney's perspective.

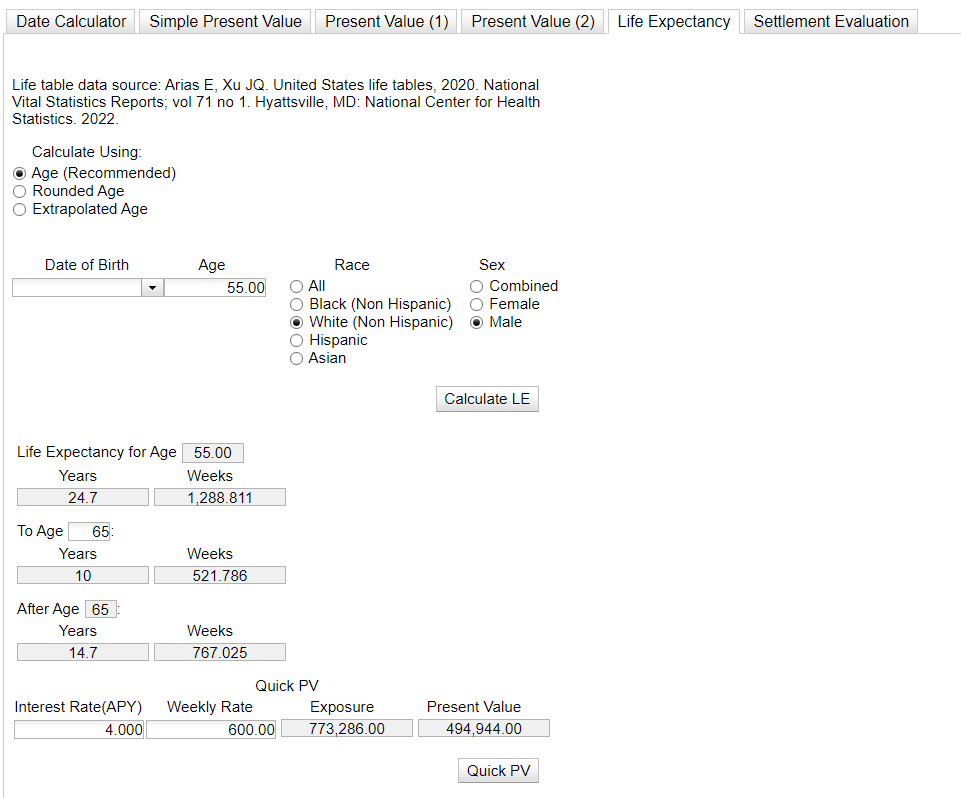

We begin by using the life table to get the worker's life expectancy in weeks. |

|

|

If COLA is not involved Present Value can be computed for the life time exposure by filling out the

bottom of the Quick PV at the bottom of the Life Table tab. It can also be calculated using the

Simple Present Value tab for time periods other than lifetime benefits.

|

|

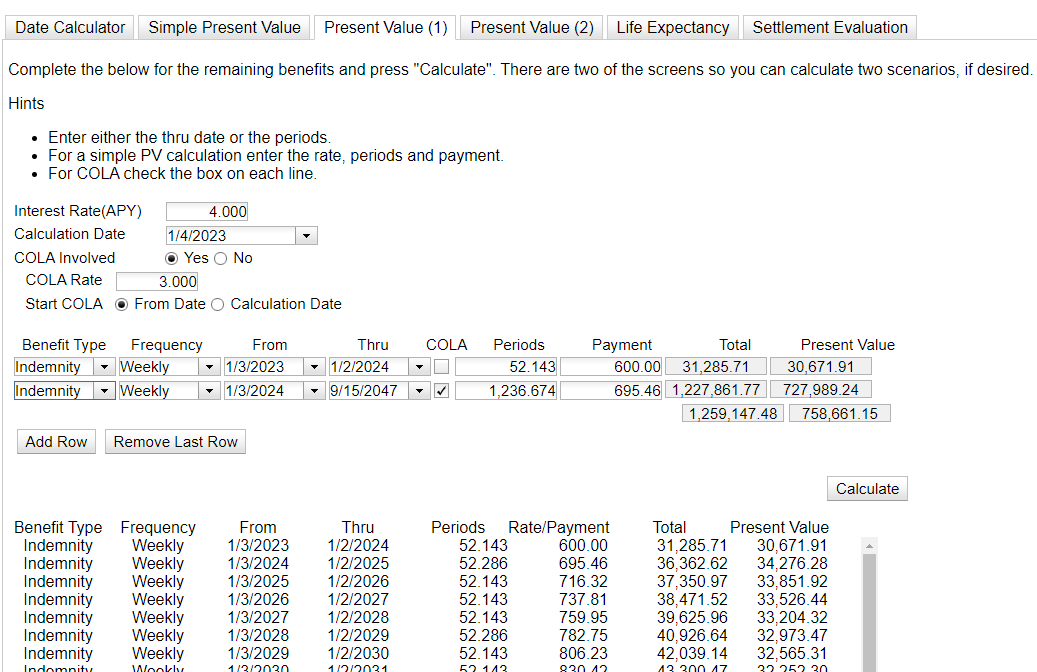

The Present Value(1) screen is completed for the lifetime benefits. We need to come up

with a reasonable Discount Rate and COLA Rate. The Discount Rate should be the rate of

return that the insurance company is getting on the investments it has. This is not

an exact science so any approach that can be justified is reasonable. Here is my approach:

Most insurance companies invest in corporate bonds with maturities that match the timing of their expected payouts. Corporate bond rates can be found by using Googling "corporate bond 20 year rate" I am going to use a rate of 4% which is in the range for 20 year bonds. The COLA Rate is jurisdictionally dependent. Some jurisdictions base this on consumer inflation rates and other jurisdictions base this on the average wages for workers. One way to come up with a reasonable rate is to take an average of COLA over the last few years. I am going to use a 3% COLA rate. This accident happened 5 years prior to the employee being eligible for COLA. He will be eligible for an immediate COLA adjustment for those 5 years. In practice the state's COLA chart would be used but in this case I will calculate 5 years of increase at 3%. The new rate once he is eligible for COLA is $695.46. (1.03 x 1.03 x 1.03 x 1.03 x 1.03) x $600. Below is the completed Present Value(1) screen. |

|

|

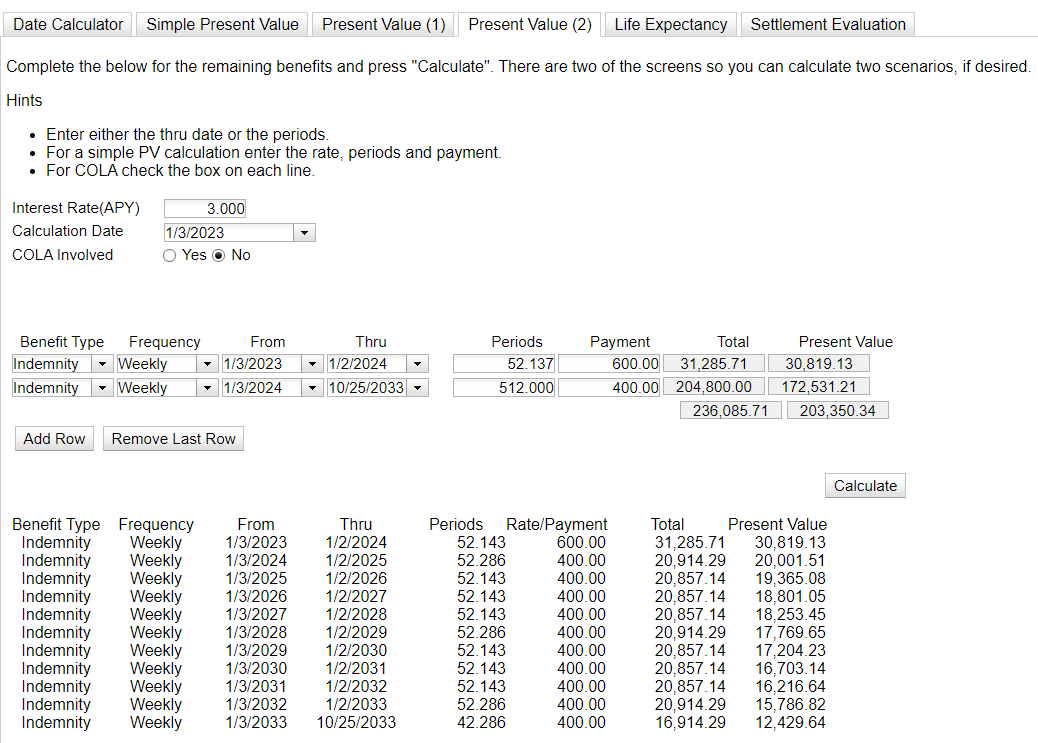

The Present Value(2) screen is completed for the wage loss benefits. I am going to use

a Discount Rate of 3%. This is a shorter term exposure so the Discount Rate should

be less than that used for the lifetime benefits. I arrived at the 3% by looking at

the range for 10 year corporate bonds.

Below is the completed Present Value(2) screen. |

|

|

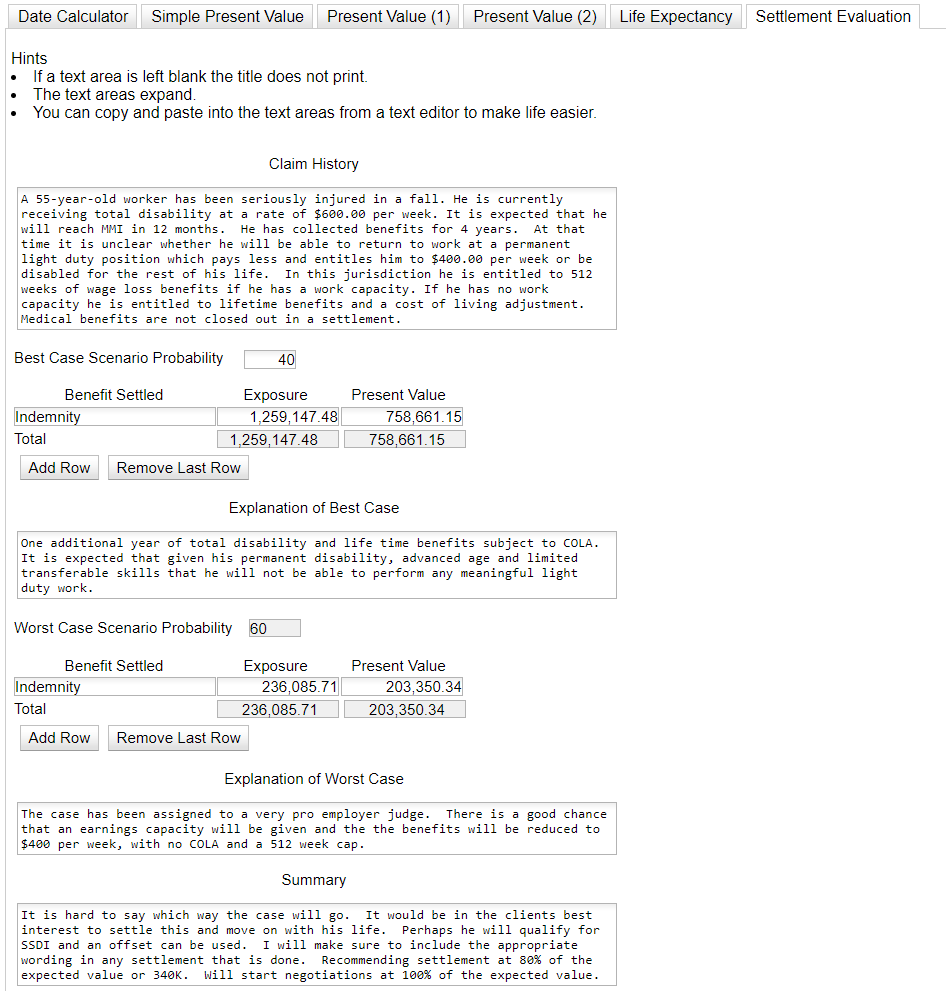

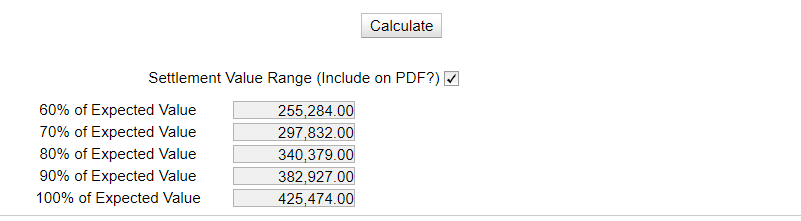

Below is the completed Settlement Evaluation screen.

|

|

|

Based on the results the case has a decision tree settlement value between 242K and 403K.

My own experience is that cases typically settle in the 70 to 80% range of the expected value.

|

Although we believe the calculations provided to be correct, we do not assume liability for any incorrect calculations. If you suspect that any calculation contains an error please e-mail us and we will research the calculation. |

|

Copyright Comp Tools Software, Inc. 2009 |